The 3-Minute Rule for Paul B Insurance

Wiki Article

The Basic Principles Of Paul B Insurance

The moment the accident happened. The names and also get in touch with details of witnesses to the accident. The climate as well as roadway conditions at the time of the mishap. The name and badge number of the policeman that arrives at the crash scene. File an insurance claim with your insurance provider immediately after the accident.

He or she will certainly: Take a look at and also take photos of the damage to your car. See the accident scene. Interview you, the other vehicle driver or motorists entailed, and witnesses to the crash. Review the cops report regarding the accident. Take a look at health center expenses, clinical records, and also proof of shed earnings related to the mishap with your permission.

Identify fault in the crash. Seek the other chauffeur's insurance firm if he or she was at fault.

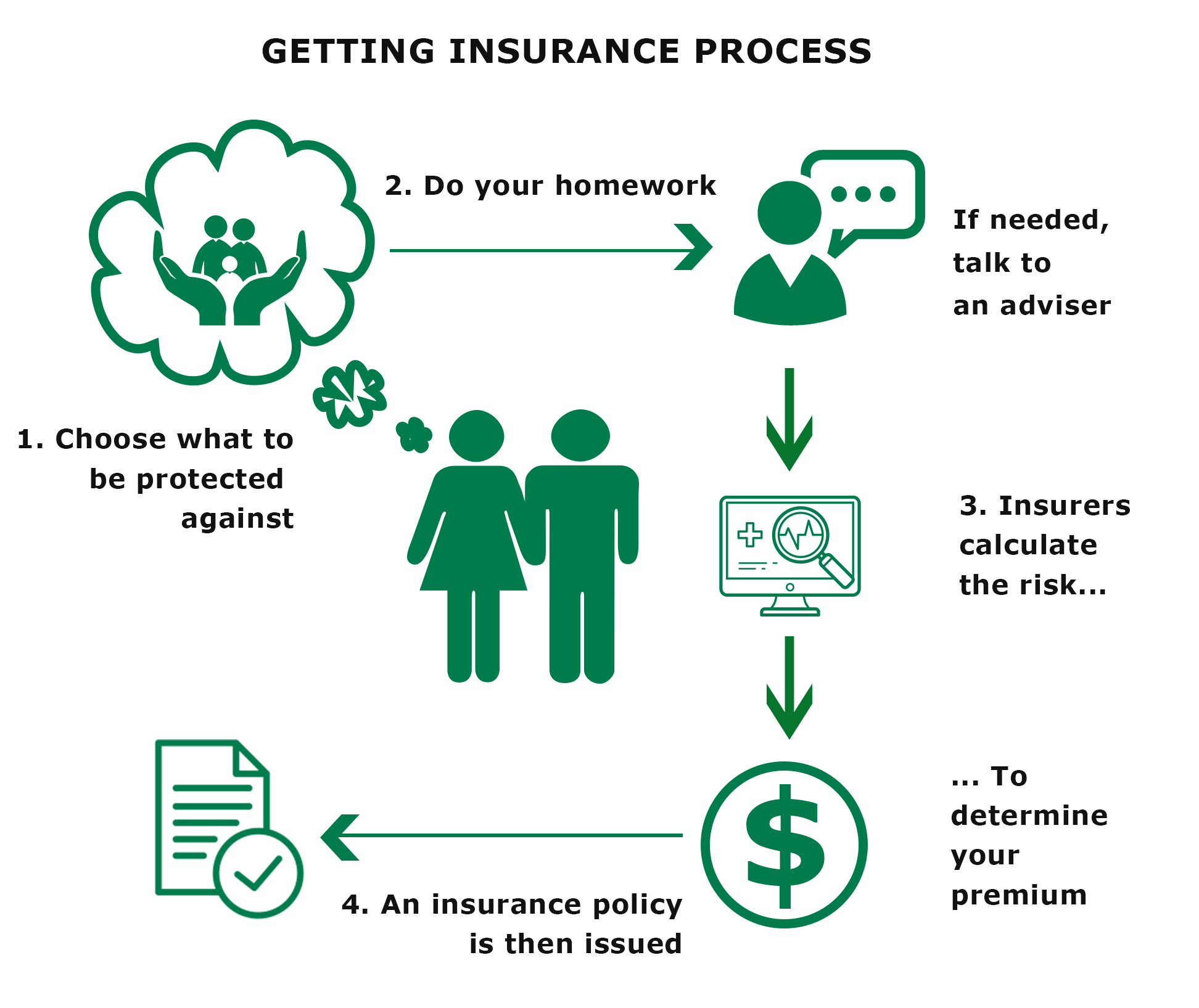

Understanding just how vehicle insurance coverage works ought to be a priority for any brand-new vehicle driver. Speak to your insurer if you already have coverage yet intend to find out more about your plan. An agent can aid you choose on vehicle insurance coverage that protects your individual assets from loss in an automobile accident.

The smart Trick of Paul B Insurance That Nobody is Talking About

As an outcome, term life insurance policy has a tendency to be more economical than permanent life insurance coverage, with a set rate that lasts for the whole term. As the original term wanes, you might have three alternatives for continued insurance coverage: Allow the policy end and change it with a new policy Restore the policy for an additional term at an adjusted rate Transform your term life insurance policy to whole life insurance policy Not all term life insurance plans are eco-friendly or exchangeable.

Although the term for the majority of policies will be an established variety of years, such as 20 or three decades, there are some exemptions. Below are a couple of instances. The free of charge life insurance policy you receive through your employer is a kind of team life insurance policy. Team life insurance policy could likewise be supplied by your church or one more organization to which you belong.

Since credit life insurance is so targeted, it is much easier to qualify for than other alternatives. Due to the fact that it covers the insured's whole life, costs are higher than a term life insurance plan.

Review extra regarding the various types of long-term life insurance below. While the insurance holder is still alive, he or she can attract on the plan's cash value.

All about Paul B Insurance

The crucial distinction is the insurance policy holder's capacity to spend the policy's money value. Throughout all this, the insurance holder must keep a high enough money worth to cover any plan costs.

On the other hand, the revenues from a high-return investment might cover some or every one of the premium expenses. One more advantage is that, unlike with most policies, the money worth of a variable plan can be contributed to the fatality advantage. Last cost life insurance policy, also called funeral or funeral insurance, is suggested to cover expenses that will be charged to the policyholder's family or estate.

It is a specifically appealing choice if one party has health and wellness problems that make an individual plan unaffordable. It is much less common than various other types of irreversible life insurance policy.

A couple of things you need to understand about traveling insurance coverage: Benefits differ by plan. Traveling insurance policy can not cover every feasible scenario.

The Only Guide for Paul B Insurance

When you inform the cruise ship line, they inform you it's far too late to obtain a refund. Without travel insurance, you 'd lose the money you invested on your trip. Thankfully, a major, disabling additional info illness click for source can be considered a covered reason for trip cancellation, which means you can be reimbursed for your prepaid, nonrefundable trip costs.

Benefits might not cover the complete expense of your loss. Allianz Global Help provides a range of travel insurance plans that consist of various advantages and advantage limitations.

You can contrast the costs and also benefits of each. It includes journey cancellation, journey disruption and journey hold-up benefits.

This cost effective strategy includes emergency situation medical as well as emergency situation transportation advantages, as well as other post-departure advantages, yet trip cancellation/interruption. If you desire the confidence of carrying considerable traveling insurance advantages, the best fit may be the One, Journey Prime Plan. This strategy also covers youngsters 17 and also under completely free when taking a trip with a moms and dad or grandparent.

Get This Report on Paul B Insurance

It gives you budget-friendly protection for a complete year of travel, including advantages for journey termination and also interruption; emergency medical care; lost/stolen or delayed luggage; and Rental Vehicle Theft & Damage protection (available to locals of a lot of states). The finest time to purchase travel insurance coverage is quickly after you have actually finished your traveling setups.

Additionally, you have to acquire your strategy within 2 week of making your read what he said preliminary trip deposit in order to be qualified for the pre-existing medical condition benefit (not available on all plans). If you're not totally satisfied with your plan, you have 15 days (or much more, relying on your state of house) to ask for a reimbursement, offered you have not started your trip or started a claim.

Strategies might supply some added advantages that Original Medicare does not cover like vision, hearing, and dental solutions. You sign up with a strategy offered by Medicare-approved private companies that follow policies established by Medicare. Each strategy can have various regulations for exactly how you get solutions, like requiring references to see a professional.

Report this wiki page